With the Chinese accessory market projected by Statista to grow annually by 5.06% CAGR between 2023 and 2026, China represents a genuine macro opportunity for bags and accessories brands, both established and emerging.

With this opportunity in mind, Hot Pot’s Insight team recently conducted a snapshot study into female bag buyers living in Tier 1 and Tier 2 cities in China. We’ve summarised the top 3 findings, which sheds light on motivations for discovery and purchase, from our study below:

-

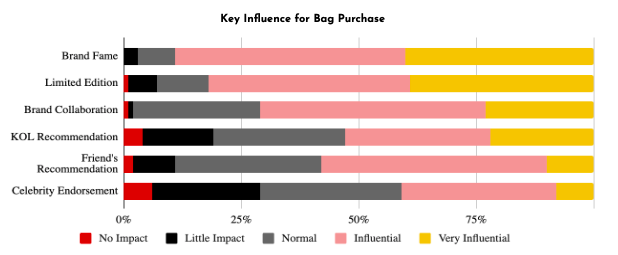

Fame rules the roost, but limited editions and collaborations are vital influencing factors in purchase

For bag brands within the range of the ‘affordable luxury’ category, priced at 3,000 RMB and above (around £360), our first finding indicates that within China it is a case of a brand’s fame being the most important factor for purchase.

Whilst fame is by its very definition intangible and subjective, heavyweight brands such as Coach, Louis Vuitton and Chanel were unsurprisingly singled out by our respondents as examples of being famous.

These maisons have decades of heritage in the category and disproportionate abilities to invest in holistic marketing to entrench themselves in top-tier Chinese city markets - hence their popularity and ability to win on brand fame.

For many Tier 1 and 2 respondents, the classic Chanel bag is

still the pinnacle of a fame brand

The Hot Pot Takeaway

You may be lucky enough as to represent the small club of brands mentioned above, but if you are reading this you’ll want to know how your brand can become famous enough to compete with the major players.

Whilst fame can be cultivated in a number of ways, the most successful strategies will be guided by brand-specific insight, take a long term view in terms of success, and be adaptable. That said, limited editions, as with Chloé’s limited edition red Marcie handbag, released a few years ago, did very well within the market.

Niche brands such as Polène could consider taking a limited edition approach to their China operations, as they did with the release of their limited colourway edition of their Cyme Tisse Bag in Europe and North America earlier this month.

-22.jpeg)

Polène has been known to release limited edition colourways for specific markets

Another route could be collaboration with recognisable IP, as with Mulberry’s partnership with the iconic rabbit Miffy for Chinese New Year this year, can both work well as activations.

Partnering with KOLs can also be a lucrative option at the tactical level, as was the case with Givenchy’s Mini Horizon bag collaboration with legendary blogger Liang Tao, aka Mr. Bags - his bag sold out within 12 minutes of going online. Get in touch with Hot Pot to find out how our dedicated influencer marketing team can help you realise brand and commercial success in the bags and accessories sector.

Moschino and Mulberry both collaborated with global IP this Chinese New Year

2. Niche non-Chinese brands have a strong opportunity to compete with their Chinese rivals

The best known brands at both premium and entry-level* unsurprisingly have the highest preferences within Chinese tier 1 and 2 cities, yet our study demonstrates that consumer sentiment is more positive and receptive in relation to niche foreign brands than it is for niche Chinese brands such as Qulu. With much being made of China’s shift towards a localised preference for China-made products, this finding bucks the trend, with these data applying to over the shoulder, backpack, and cross-body variants of products.

* The premium and entry-level luxury category is determined by claimed spend, i.e. entry level luxury brand are those with bags typically priced between 3-7K RMB, and premium luxury bag is typically priced 7K-10K+)

The Hot Pot Takeaway

Players in the category with untapped followings on Chinese platforms like RED in particular, should be encouraged by a tilt towards niche brands. These data support the case that there remains an appeal in China to sporting brands which are not as common (or typically not as pricey) as the entrenched category leaders. We’d advise niche bag brands, all of which have emerging followings, should strongly consider methodical market entry or optimisation in China to capitalise on this favourable playing field.

3. Style and Product design should feature in messaging. Sustainability claims are less influential.

A recent study on Statista found that around 60% of Western consumers saw sustainability factors as important when influencing fashion purchases. Conversely, our China specific research indicates that for a female Chinese buyer based in Tier 1 and Tier 2 cities, a brand’s sustainability credentials only ranks in 25% of cases as a top buying factor.

This makes sustainability far less of a determining element when compared to aesthetic and quality factors such as product style, brand and material. A bag’s style, what sets it apart as distinctive and desirable, and its iconic design elements are mentioned as the top factor in over 70% of cases.

A good example of a brand with distinctive style and product design (and with emerging popularity on Chinese social media platforms) would be Danish waterproof backpack and tote brand Rains. Its signature waterproof polyester fabric, textured zips, muted colourways and subtly indented logo are all features that uniquely distinguishes itself from its competitors.

Note the signature look and texture of this Rains bag, which Chinese consumers value more than sustainability

The Hot Pot Takeaway

For brands with global messaging strategies informed by the fashion industry’s move towards a more conscious consumption and preference for issues like ethical production and supply chain, it is important to be under no illusion that whilst this is still a factor in purchase, the Chinese mentality towards these issues is far less entrenched like in Western luxury markets.

From a messaging perspective, unless intentional to target specifically ethical purchasers, leading with a style and design heritage is likely to be better resonating for brand building in the bag category, rather than a purpose-driven approach to messaging.

Underpinning this takeaway is Hot Pot’s firm belief in brands really taking the time and space to inform the localising of messaging through insight and perspectives from a bicultural partner who has expertise in the region. Additionally there are important and often immediate opportunities to build brand equity and drive sales with overseas Chinese consumers as a quick-start way into the market.

In a year where travel from China to overseas fashion hubs across Asia and Europe, i.e. London, Paris and New York, there is a major opportunity to capitalise on this rebounding demand in the bag and accessory sector.

If you are an accessory brand looking to enter the Chinese market, optimise existing operations, or a retailer looking to capitalise on Chinese inbound travel, please reach out to our insight team for a chat at nihao@hotpotchina.com

Related blog posts