Chinese social media platform Little Red Book is arguably THE platform to be on if you're looking for effective marketing results among the Chinese-speaking community.

Even football star Kylian Mbappé joined in April, actively creating content in direct collaboration with the platform.

NB: We use "Little Red Book" despite the platform’s official name being Xiaohongshu (小红书) as it’s more accessible to non-Chinese speakers. The platform itself also uses the term “RED”

Where Do Brands Get it Wrong?

On entering and growing in China, many brands approach launching Little Red Book as they would any other social platform, namely:

-

secure and register an official account

-

draft and produce a set of high-quality polished on-brand content

-

start publishing

-

wonder why their following is not growing at the same rate as their Western channels

-

throw money at paid ads in the hope of improving numbers.

Unlike other social media platforms where focusing on owned content and official accounts is the norm, this approach yields slow growth and minimal impact on Little Red Book. Why is this?

Little Red Book Is NOT Instagram

Let’s get this straight before we dive in. Describing Little Red Book as China’s equivalent to Instagram is to hugely downplay its breadth, depth and strengths as a marketing platform. While its layout may remind some of Instagram or Pinterest, its impact extends far beyond, resembling a combination of Google, Amazon, and Instagram.

Little Red Book has become an indispensable marketing tool for brands worldwide. With its 260 million monthly active users, brands can connect not only with the Chinese market but also with the global Chinese diaspora, who are high-value heavy users.

Little Red Book was founded by Miranda Qu and Charlwin Mao in Shanghai in 2013. The duo originally started the app as an international guide for Chinese shoppers to review products and share their shopping experiences.

Over time, content expanded beyond shopping, fostering a strong sense of community where users actively discover and share new brands, products, ideas, and lifestyles. Additionally – although it’s not yet a mature function – Little Red Book currently integrates an in-app shopping interface, allowing users to explore, search, and purchase products. Many active Little Red Book users have transformed into influential Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs), actively collaborating with brands and monetizing their content.

The Critical Secret All Brands Need To Know

on Little Red Book

Users don’t want to hear from brands.

Users want to hear from users.

In Chinese culture, word of mouth (WOM) from peers and trusted sources has been the most valued and authentic way to evaluate information. In the modern world social media, and Little Red Book in particular brings this to life in the digital domain. This means a brand can shout all it likes with glossy, studio-produced content, but if this is not backed up by adequate levels of quality user reviews by real humans then it will not be effective.

Users seek tips, inspirations, and recommendations for everything from outfits to snacks, and from restaurants to travel destinations. Brands need to focus the vast majority of their initial efforts on encouraging, curating and maintaining this user generated content. At Hot Pot China we have even worked with brands for up to six months on these efforts before launching the official brand account.

This is known in Mandarin as “zhongcao种草,” literally meaning "planting grass," which describes the effect of recommendation-based marketing. In 2022, Little Red Book contributed over half of all zhongcao content in the Chinese ecosystem, more than the other major social media platforms like WeChat, Douyin, and Weibo combined.

Given this, users often search for products and seek reviews from trusted KOLs or KOCs on Little Red Book, consulting their peers before making a purchase decision or checking out a brand or product’s official page. It’s straightforward: consumers trust personal endorsements over paid ads.

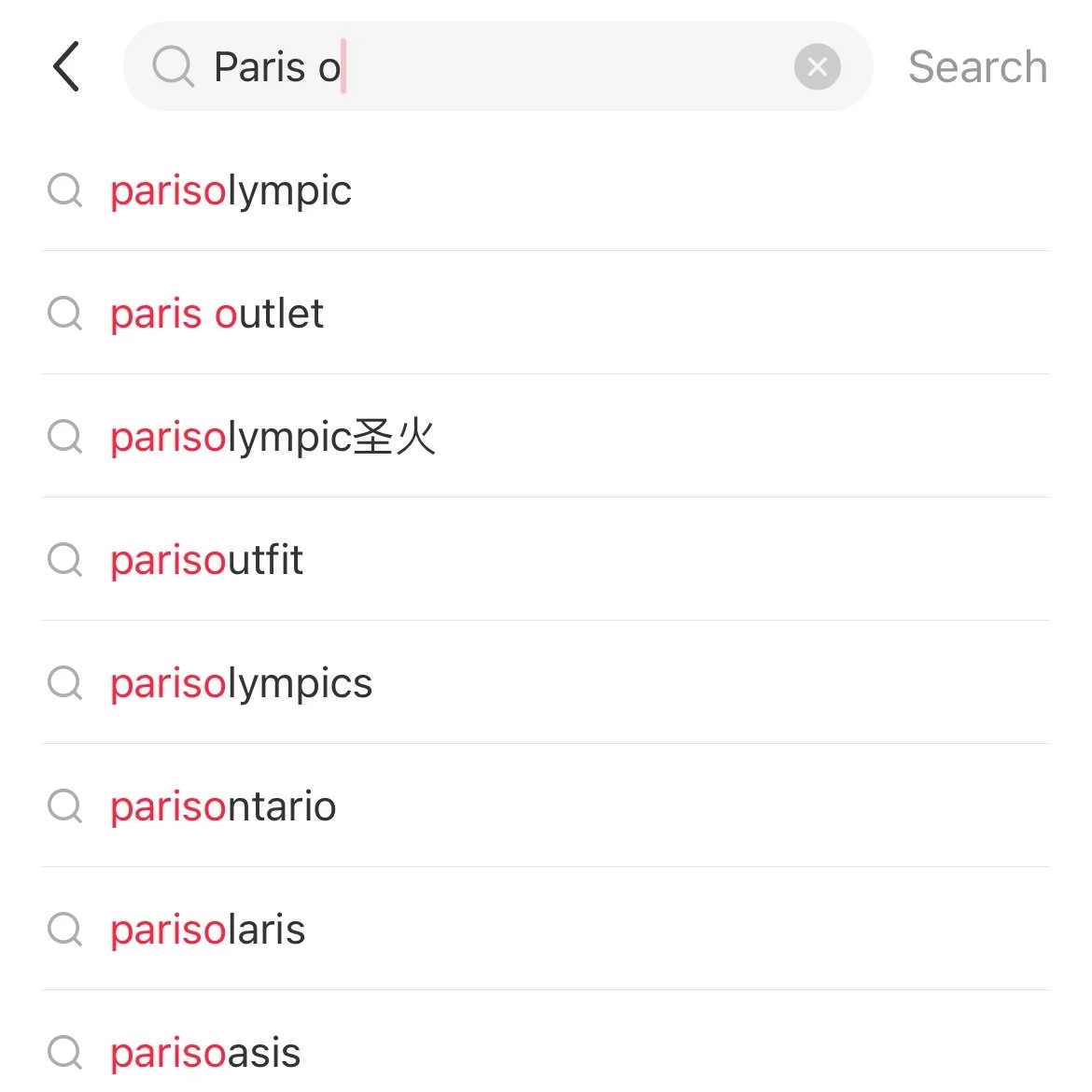

For example, for summer necessities, they may search for generic keywords like summer skincare or sun protective clothing, and eventually discover a brand or two after first scrolling through and prioritising hundreds of zhongcao posts.

KOL/KOC Collaborations

The goal of success on Little Red Book is to establish an active zhongcao content system. Collaborating with influencers is the starting point and a shortcut to building this ecosystem. Before any official launch or announcement, focus your efforts on identifying influencers whose voices align with your brand image. Build relationships and encourage them to consistently push out high-quality user-generated content (UGC) as the foundation of effective marketing on Little Red Book. With a robust zhongcao content system in place, people will genuinely be interested in your product or brand, actively seeking out content and channels to purchase.

Also in this world, bigger is not necessarily better - prominent KOLs or celebrities have major reach but are expensive and lack the relatability of grassroots influencers; rising KOCs, who may have only 5,000 followers but consistently provide high-quality content, may generate more traffic and trust. You can read more about KOL marketing in China in our previous article.

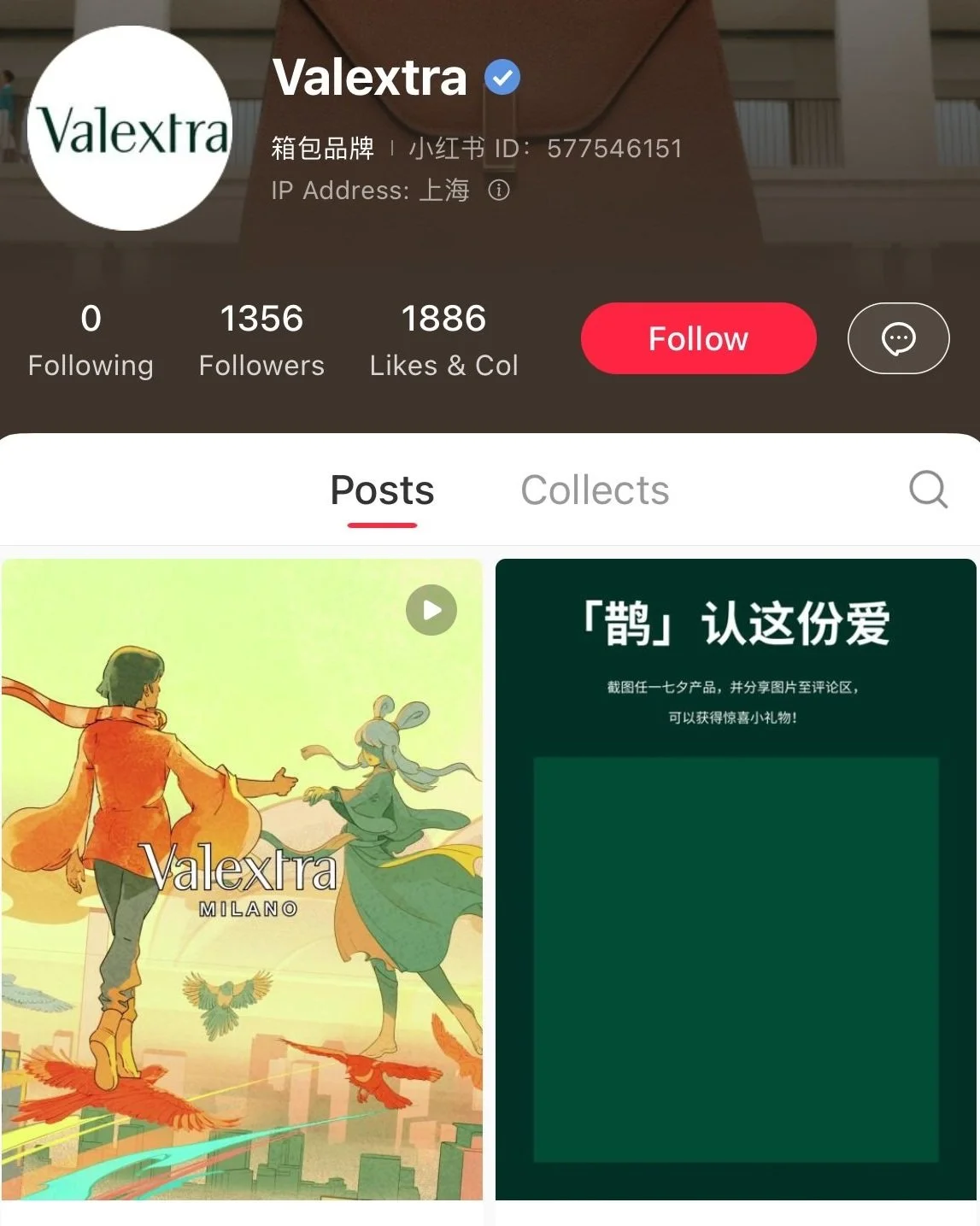

Official Account

Once your brand and products have gained traction on Little Red Book and established a solid foundation within the community, it’s time to focus on an official account to enhance authority and credibility.

While visuals are essential on Little Red Book, don’t overlook the text copy. Users with specific needs look for detailed and reliable information, such as product reviews and proof of efficacy. It’s important to have the right balance of crafted on-brand copy designed to elicit an emotional response, and the details oriented product posts that will drive users towards the purchase end of the funnel.

Become a seller

Similar to Amazon, sellers need to sign up and get approval before selling on Little Red Book. As Little Red Book is still establishing its position in China’s e-commerce realm that’s largely dominated by Taobao, Tmall, JD.com, and Pinduoduo, early movers in the space can typically enjoy new seller incentives when working with a trusted partner like Hot Pot China to negotiate terms.

Buyer & Livestream

Livestream shopping is a major and sustained trend in China, where people tune into livestreams for deals and direct communication with sellers. Early players like Taobao started in 2016 while Little Red Book only entered the livestream shopping field in 2020.

With popular livestreamers like actresses Dong Jie, Teresa Cheung, and singer Annie Yi, Little Red Book livestreams have rapidly gained popularity. Unlike traditional livestreams, they explain products and deals in a calm and sophisticated way, typically targeting wealthy young women who prefer quieter, more informative sessions over the “buy buy buy” attitude of many platforms.

Hong Kong-born socialite and actress Teresa Cheung, known for her fine taste and luxury lifestyle, debuted on Little Red Book livestream in May 2023, garnering USD 7 million in Gross Merchandise Volume (GMV) from nearly a million viewers. Her second livestream in October doubled this GMV.

Little Red Book also introduced a buyer买手 feature last year. Any adult with real-name authentication and over 1,000 followers can apply to become a buyer on the app, promoting their own products or selecting from Little Red Book’s product centre. They earn commissions through purchase links in their posts or livestreams. This initiative aims to attract more brands and sellers, essentially completing Little Red Book's own supply chain and e-commerce ecosystem. Brands can collaborate with these buyers to boost product awareness through livestreams.

All images via Little Red Book

How to Win?

Does the above ring true with your experience of China marketing? Are you experiencing low growth on Little Red Book and worry you may be putting spend in the wrong areas?

Contact the Hot Pot team at nihao@hotpotchina.com. We have deep expertise in Little Red Book and take a “think outside the box” approach to setting up success on Chinese social media platforms.

Related blog posts