In this article, Hot Pot strategist Pippa Ebel delves deeper into China’s bike industry and the most important developing trends.

Bananas for Bikes

Few business owners would make the claim that 2020 was a ‘good’ year. However, amongst the small group of companies that have seen growth during the pandemic, bike businesses certainly seem to be one. Propelled by Covid-19 regulations and a latent fear around public transport, people across the globe have rushed to buy bicycles, bringing the total market value up to a whopping $65bn. China is no exception. By imposing strict preventative measures, the government dealt a generous hand to the fitness industry, which saw surges in sales of home equipment and fitness apps. Unsurprisingly, sales of indoor and outdoor bikes shot up, with local brands such as Phoenix selling as many as 600,000 bikes every month.

So is China’s bike boom here to stay? Or is it just the latest trend to gain heat amongst China’s increasingly capricious consumers?

Move Over, Peloton

For many around the world, Covid-19 has been a stark reminder around the importance of staying fit and healthy. In China, this has manifested in a rising interest in nutrition and clean-eating, and of course sport and fitness. As gyms closed, new opportunities to work-out arose, namely in the form of home workouts, running and cycling. Enter the Chinese peloton.

Since its inauguration in 2014, Peloton has enjoyed a seismic rise in Europe and the US. Popularised through snazzy advertising (minus their 2019 Christmas blip) and celebrity endorsement (shout out to Mr Branson), it has stayed in the limelight. However, in China the indoor bike is a far more recent phenomenon, propelled by the pandemic. Its popularity is best captured in local brand Keep, which first established a name through its user-friendly fitness app. Leveraging its robust consumer base, it launched its first indoor bike in November 2019. Within six months, it had sold 20,000 units.

The reason for its popularity? Timing and price. The fact that it launched its product just months before 1.4bn people were ordered to stay at home was certainly fortuitous. However, the fact that most Keep models retail at under 3000RMB (the equivalent of $470), a mere quarter of the retail price of a Peloton, makes its bikes extremely accessible. The indoor bike’s popularity has outlasted fanatical lockdown purchasing, with Keep continuing to sell 700 units of its most expensive model every month through Tmall. This sales figure represents just a fraction of the company’s total monthly sales.

With some models retailing at 1699RMB, the equivalent of $270 it is hardly surprising that Keep’s bikes are selling like hot cakes.

Switching to Online

Keep’s success highlights another key shift resulting from the pandemic: conversion to online purchasing. Sectors of the market such as heavy equipment, technology and more expensive luxury retail have to date been slower in joining China’s shift to Ecommerce. Unsurprisingly, buyers are reluctant to wire over large sums for goods they haven’t seen, felt or worn. However, during Covid, they were left with little choice. This has meant that over the past 18 months purchasing habits have changed fundamentally. More and more shoppers are willing to buy most items directly from online stores, from luxury watches, to bicycles. In a recent Hot Pot survey recruiting Chinese cycling enthusiasts, 54% said they had bought their bikes in store, with the remaining 46% making the final purchase online.

The 2020 sales figures of local bike producer Phoenix confirms this trend. Although its roots extend back to 1958, this Shanghai-based company’s operations are far from traditional. They were quick to adapt to Ecommerce and have reaped the rewards. By ramping up their online activity, with a particular focus on children’s bikes, they were selling over 20,000 bikes monthly just through their online stores in 2020.

New Reasons for Riding

The typical commute in China certainly used to be a two wheeled affair. Bikes were a mode of transport; a way of getting from A to B. More recently however, Chinese consumers’ motivations for cycling have been changing, with almost 70% of Hot Pot survey respondents claiming they ride to keep fit. This shift is confirmed through the emergence of spinning in China, which was originally offered as an additional class in several large gym franchises, before evolving into spin-specific studios such as BeCycle and FlowCycle in Shanghai. For many in China today, cycling is seen as a serious sport, one whose benefits extend beyond just physical health.

When asked why they cycle, Hot Pots’ insight team were surprised by the length and detail of the participants’ responses. “I feel free and comfortable. It sets aside the pressures of work for a while.” Many answers focused on the emotional benefits of riding which for many offered mental rest, comfort, as well as a sense of freedom and joy.

Hot Pot survey revealed over 67% of respondents are motivated to cycle for health reasons. Interestingly, less than 5% cite ‘commuting’ as their reason for using a bike.

The Rise of Club Cycling

Amongst the answers we received around the reasons for cycling, many respondents mentioned the social facet of riding. “I can enjoy relaxing and happy times with friends on the bike”, one respondent says. Another talks about finding “like-minded friends” through cycling. The social factor is a key one for riders in China, confirmed by the fact that only 20% of respondents claimed to cycle alone.

Several international brands have already leveraged the emerging interest in club cycling, with Brompton bikes launching its ‘Chill Ride’ event series in key Chinese cities such as Shanghai. By tapping into the growing interest in social riding, and delivering an effective campaign through social media, Brompton’s brand awareness has increased significantly. Even for brands that haven’t yet entered the mainland market, such as Rapha, there is clear organic interest and appeal in the brand’s social and community-centric ethos. Although it has no formal presence in China Mainland, it has already accrued 1.1 million followers on Weibo, and its Clubhouse in Hong Kong attracted much attention when it first opened in 2019.

Rapha successfully tapped into the rising awareness of social or club cycling,

with their Hong Kong chapter which opened in 2019.

Takeaways for bike brands looking at China

-

An increasingly fitness-conscious consumer

Awareness around and interest in fitness is a trend that is here to stay in China. Whilst that has currently centred around sports like running and cycling, it is likely to expand to include more extreme and niche sports, as we are beginning to see with sports like surfing and bouldering becoming increasingly popular.

The concept of leisure cycling and spinning is still in its infancy, but there are signs it will not just continue but intensify. For bike businesses, a new group of consumers is emerging. The time to engage them with localised relevant messaging is now. -

Changing purchasing habits

Buying a bike at a store is no longer the only option. An increasing number of consumers are happy to purchase bikes through online channels, either directly, or having made their decision of the model in store.

For bike businesses it is increasingly important to incorporate this o2o purchasing model into their sales strategy and make sure that their journey from store to online is as seamless as possible. -

Diversification of the Chinese cyclist

Whereas before bikes were primarily used as a form of transport, today cycling in China appeals to an increasingly diverse group, who are drawn to the sport for different reasons. There is the fitness-conscious spinner, keen to invest in a cheap local brand of indoor bike to stay fit during times of pandemic restrictions or heavy pollution.

There are the serious, professional cyclists who are training to compete and own several top quality bikes. There is the leisure cyclist, who rides through the city after work on their Brompton, or even a shared bike, to relax with friends.

As the consumer profiles become more varied, the landscape becomes more nuanced for bike brands operating in China. Brands need to invest in finding out who their precise target audience is, and what their hopes and expectations are. -

The emergence of a cycling culture

Given that the Chinese have been cycling since bikes were invented, it’s hardly surprising that there are currently half a billion bicycles in China. However, the ideas and motivations behind cycling are undergoing significant change.

Cycling has emerged as a way to exercise, relax and socialise, heralding a new riding culture. This cycling movement, though currently still small in population percentage terms, presents a significant opportunity for international brands who can leverage their associations with community riding and lifestyle, to reach new Chinese consumers. -

The appeal of international brands

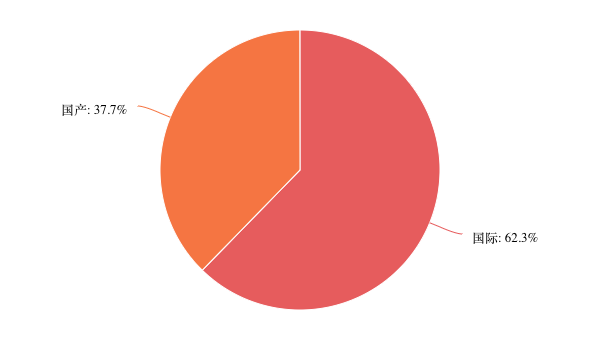

Although household local names such as Phoenix and ForeverBikes still take the market share of bikes bought in China, International brands such as Giant and Trek perform extremely well in the market. Importantly, more specialised brands such as Brompton, Rapha and Gore have significant appeal amongst Chinese riders who are familiar with and follow these brands.

As an international brand it is important to understand how you are being perceived by Chinese consumers, and what they define as your unique selling point. Only then can you communicate with the market effectively and tap into organic traction.

China’s bike boom is here to stay.

How can your brand make the most of it?

.png)

Over 60% of cycling enthusiasts prefer international cycling brands over local ones.

Get in touch if you wish to find out more about how China’s latest trends might affect your business, or if you would like to know what opportunities might lie in store for your brand.

Image Sources: SupChina, TMall, Rapha Official Website

Related blog posts