UNFULFILLED POTENTIAL

During last year’s Singles’ Day, beauty brands came out on top. The category saw a 117% growth on last year’s pre-sales, with many new entrants vying for Chinese consumers’ attention. But while the sales figures Estee Lauder and L’Oreal were eye-watering, not all brands reaped the rewards they were expecting.

In this article, we look beyond the glossy headlines, focusing instead on 5 beauty brands that are not yet fulfilling their potential in China. Through our competitor and performance analysis tool known as the China Success Index, we will take a closer look at Liz Earle, No. 7, Huda, Elemis and Benefit.

CHINA SUCCESS INDEX (CSI)

Every quarter, Hot Pot’s strategy and insights team carry out in-depth research into a particular category by analysing the performance of different brands within the Chinese market.

Known as the China Success Index, our methodology leverages tools such as Tmall/Taobao sales data, social listening, search indices and desktop research to assess brands across critical metrics. These metrics are primarily brand visibility, transmission of global brand messages, customer sentiment and performance against competitors.

Our CSI ensures the Hot Pot team stay ahead of major industry trends, discovering new players and opportunities in the market. It enables us to provide important insight to clients about their performance in market, supporting them realise brand and commercial success.

Tough competition and increasingly demanding consumers

#1 - LIZ EARLE

Liz Earle, despite making $5.5million in global online sales in 2020, has not yet entered the Chinese market. Its lack of official presence on social channels and eCommerce platforms makes it invisible to Chinese consumers, and yet, organic buzz around the brand reveals a considerable opportunity.

Without any investment, Liz Earle has attracted a significant following on Little Red Book, with over 230 tagged posts, some of which received over 600 likes. On WeChat, coverage of the brand through established online beauty advisors has made the brand more accessible to Chinese consumers interested in exploring new products.

-

Brand Visibility: 0/5

-

Brand Representation/Accuracy: 0/5

-

Customer Perception: 3/5

-

Competitive Performance: 0/5

-

CSI Rating: 1.5/10

Liz Earle has gained significant organic interest. It is featured by several beauty publications on WeChat and is a popular choice amongst bloggers on LRB (above).

Hot Pot Recommends

Liz Earle should consider how best to capitalise on existing organic interest in China. As much noise surrounding the brand centres around its British identity, the brand should consider how to leverage its UK-based Chinese consumers. This can be done by engaging UK based affiliate networks, which would specifically target high-interest buyers, in Liz Earle’s case, Chinese students. By leveraging an already active support base, awareness around the brand will permeate the domestic consumer’s awareness. Once this domestic approach is underway, the brand can better evaluate its chances of success in the China market, leading to a more thorough and strategic approach.

#2 - BOOTS NO.7

Given its local success in the UK, it is surprising that Boots’ owned brand - No.7 - is barely visible in China’s beauty market. Appeal for the product is evident by the fact that over 23,000 TMall customers have saved one of the brands’ only available products on the platform, and despite its low brand awareness, No.7 still sells to 300 Chinese customers monthly. The interest is there, but the brand is doing very little to encourage potential customers to buy.

-

Brand Visibility: 1/5

-

Brand Representation/Accuracy: 3/5

-

Customer Perception: 3/5

-

Competitive Performance: 1/5

-

CSI Rating: 4/10

No.7’s leading serum product has over 23,000 saves in consumer’s digital carts, and has over 300 purchases every month. The products are particularly well received by consumers, with over 5000 positive reviews on JD.com

Hot Pot Recommends

Boots should consider how to drive awareness of No.7 products, with the goal of channeling potential customers towards their online Boots TMall store. By analysing which platforms are most suitable for their target consumers, they will be able to streamline their marketing efforts.

By collaborating with KOCs (Key Opinion Consumers) on Little Red Book, No.7 will gain more visibility on the platform, giving them a strong foundation through which to launch their own official account. By raising their profile on social media, Boots can then drive consumers to their online stores on TMall and JD.com, completing the purchasing journey.

#3 - HUDA

Huda has emerged with groundbreaking force on UK shelves - yet another dynamic new American beauty export to have landed well with British consumers. Nor was their success limited to the UK. That three hundred of their best-selling lipsticks are being bought monthly from their Tmall Global online shop, reflects the waves that Huda has been making in China. However, the brand is missing out on greater visibility due to its absence of a quality presence on core social channels such as WeChat. Additionally, the brand could be doing more in terms of localised content and messaging, relying heavily on translated global content, a surefire way to seem inauthentic to Chinese consumers. Primarily, their lack of Chinese name makes them difficult to find for Chinese consumers, and their imagery is in danger of seeming too Western-centric, alienating potential Chinese buyers.

-

Brand Visibility: 2/5

-

Brand Representation/Accuracy: 1/5

-

Customer Perception: 3/5

-

Competitive Performance: 2/5

-

CSI Rating: 4/10

Tackling unofficial social accounts is a common problem for brands. Huda still hasn’t established an official presence on China’s main social media platform, WeChat. Instead, the brand is only visible through the unofficial account pictured above, called ‘Huda Beauty Nude’.

Hot Pot Recommends

Huda would benefit from a precise definition of what their brand means for Chinese consumers. Given the size of the category, it is essential for brands to communicate their unique identity to consumers, for instance Huda’s position as an innovative, edgy Californian brand trusted by celebrities and royals.

This kind of brand definition is essential for effective communication with consumers, as well as ensuring long-term brand equity. Huda should prioritise gaining insight into relevant categories and consumers, in order to identify their relevant target audience and build out a localised brand positioning, with suitable messaging and imagery.

Besides this, Hot Pot would advise prioritising WeChat, leveraging the power of content, private groups, mini-programs and CRM tools to develop a loyal community of repeat customers.

#4 - ELEMIS

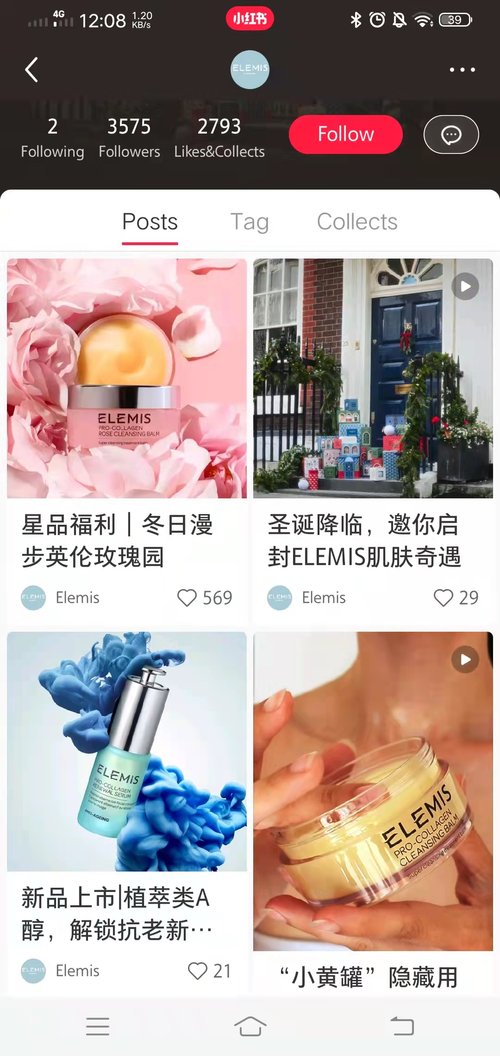

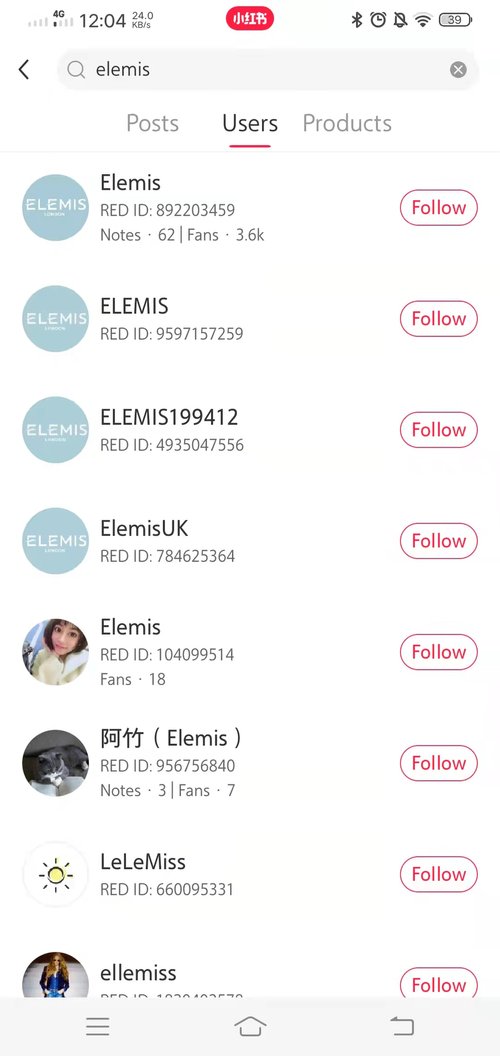

Elemis have ramped up their China efforts in the past 12 months, driving awareness around the brand through official accounts across China’s main social media channels such as WeChat, Weibo and Little Red Book. This provides them with a stable foundation in the Chinese market, but doesn’t place them competitively against other international brands.

Their messaging is largely product versus consumer driven, and their channels do not sufficiently engage and educate consumers about how their product might be used, and why. This, compounded with infrequent communication, leaves potential consumers disengaged.

Although they have begun collaborating with brand ambassadors and prominent live streamers such as Li Jia Qi, they have been largely unable to capitalise on the interest these collaborations generate, since the brand-owned platforms do little to incentivise potential followers. Whilst some of their products, such as their balms are seeing strong sales on TMall, performance is not consistent across different ranges, preventing them seeing long-term sustainable sales growth.

-

Brand Visibility: 3/5

-

Brand Representation/Accuracy: 4/5

-

Customer Perception: 3/5

-

Competitive Performance: 2/5

-

CSI Rating: 6/10

Compared with Shiseido whose official account has over 225,000 followers, Elemis (who has less than 3600) focuses much more on the product than the consumer. The number of unofficial accounts on the platform pose additional challenges for the brand’s credibility as well as visibility.

Hot Pot Recommends

Elemis should first optimise their existing marketing assets, ensuring every platform looks and feels official and reputable. As so many consumers set up brand-named accounts, Elemis should ensure the integrity of the brand is preserved by signalling to consumers which account is the officially authorised voice of the brand.

A Chinese name would help the brand be more easily searchable for Chinese consumers and build additional brand equity. Besides this, Elemis would benefit from a more consumer-centric approach to their products, reflecting how Chinese customers use and enjoy them. Chinese consumers are increasingly appreciative of a story-telling led marketing approach, which inspires an emotional connection between them and the brand. Elemis would do well to prioritise this in their marketing approach and brand tonality.

#5 - BENEFIT

Despite investment into local collaborations with celebrities, department stores and China’s Ecommerce platforms, Benefit has seen a decline in popularity amongst Chinese consumers in recent years. Having entered China relatively early back in 2007, Benefit has struggled to maintain consumer engagement. This is due to a narrow focus on a single product line (brows), as well as its failure to keep up with new trends and innovations. Although sales are consistent on TMall, they are relatively low given Benefit’s size and time in market. Despite efforts to build a meaningful offline presence across China’s major cities, Benefit failed to see return on investments and saw store closures last year.

-

Brand Visibility: 3/5

-

Brand Representation/Accuracy: 4/5

-

Customer Perception: 2/5

-

Competitive Performance: 2/5

-

CSI Rating: 5/10

MAC used their offline presence to drive visitors to their online stores, successfully joining their retail channels. MAC responded to recent innovations within the retail industry, giving customers an immersive digital experience that enables them to trial new products in a fast, effective and fun way.

Hot Pot Recommends

Benefit should consider a full brand reset, standing back and re-evaluating where they are in the market now, almost 15 years after they first entered. This would look at new competitors with fresh eyes, as well as their target audience which may well have changed. By re-evaluating these, the brand will be able to begin looking at their position on China’s core channels. They should focus on optimising CRM tools across their entire ecosystem, ensuring customers are connected and retained. This is being done very effectively by brands such as MAC.

The MAC approach of integrating online customer tap-in in their offline stores ensures the end-to-end binding they need to keep their customers engaged. Rather than seeking to emulate pop up and store presences that have been successful in America and Europe, Benefit should get cosy with their potential consumers so they can make a more targeted and localised offering for their Chinese buyers.

Wrap Up

With changes to animal testing laws in China last year, the opportunity for international brands working in beauty and wellness has never been bigger.

The gates have sprung open, and more importantly, China’s leading Ecommerce platforms are working hard to promote new entrants, particularly less well-known, niche international brands. However, for international brands to make the most of the China opportunity, it is essential to know the size of the opportunity, as well as how and where your brand will be positioned in the market.

Get in touch with the Hot Pot China team to understand how your beauty brand can realise its full potential in the China market through our bespoke services across brand, digital and China Ecommerce.

Related blog posts